When done correctly, your budget should end any given year with about 5% of their income left over. A budget should allow for error and so keeping expenses 5% or 10% below the estimated income is a conservative approach. Spending, which will be relatively constant, needs to be maintained below that amount. No matter what your financial objectives, a good family budget will help you move toward them in an organized and controlled fashion.Ī budget needs to estimate your average (yearly) income. What sort of financial goals can a family budget help you achieve? Getting out of debt, saving for retirement or for your children`s education, or saving for that vacation or boat are just a few of your options. Also like how the author introduces pages or numbers in keynote so.

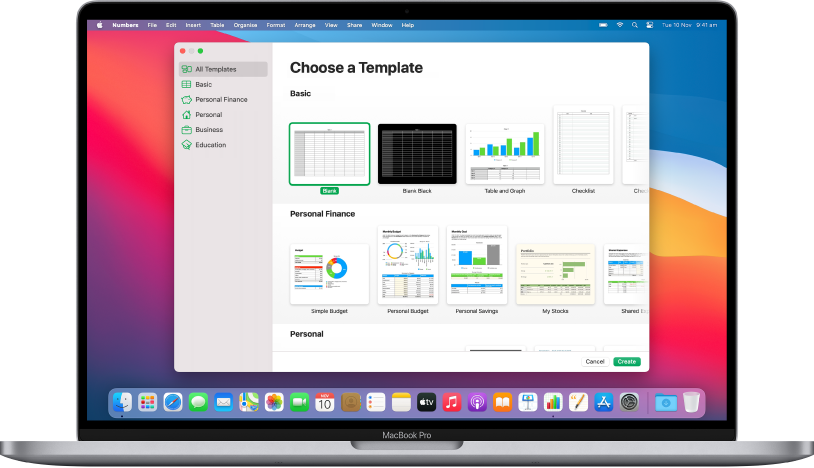

Knowing exactly how much income you have and how many expenses you have allows you to outline a road map that will help you reach your financial goals. iWork 09s template browser makes it easy to choose from a variety of document. In times when everybody makes less and everything costs more, developing a family budget and committing to it is one of the best ways you can improve your financial situation and secure your family`s future. Budgets with irregular income should keep two things in mind: spending more than your average income, and running out of money even when your income is on average. Precautions need to be taken for budgeting on an irregular income. Good thing there are now plenty of tools that will be able to help you out in budgeting, a task that can be frustrating, depressing and tedious all at the same time. A lot of families and individuals are actually facing a grave problem of how they will be able to make both ends meet, especially now when the prices of almost everything are skyrocketing. They should also put together their expected expenses in the coming 12 months matching it with their expected family money they will receive in that period making sure they will not spend more than they would receive.īudgeting is not an easy task, especially when you do not have enough money to budget in the very first place. In doing this, they should make allowance for any shortfall in their expected family money in that period. Families should plan in advance how much they may spend during the following 2 to 5 years in line with their expected family income during that period. The chances of getting debts is actually very small since you can easily check the exact money that you still have to make it work for your expenses.įamily Financial Planning And Budgeting. In a budget template, you will list down all the accounts that you have and this will surely allow you to have more savings.

0 kommentar(er)

0 kommentar(er)